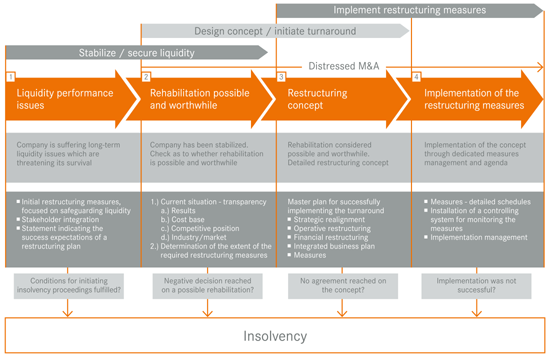

First of all, we must determine whether the survival of a company really is at risk. To achieve this, we focus on the company's cash-flow situation.

In some cases, a single measure aimed at restructuring the finances, achieved through successful moderation with the financing group, is sufficient to ensure that the company remains capable of functioning. However, should there already be liquidity issues, the first step is to stabilize the company by introducing effective short-term liquidity-improvement measures. Such measures are focused on generating additional liquidity and restoring a healthy capital base. These can be supplemented by measures aimed at achieving a reduction in costs and an increase in turnover in the short term.

Cost reduction measures may include improving efficiency in existing structures or the introduction of structural changes.